BTC holds the line after US downgraded

Friday August 4, 2023 - Issue # 48

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

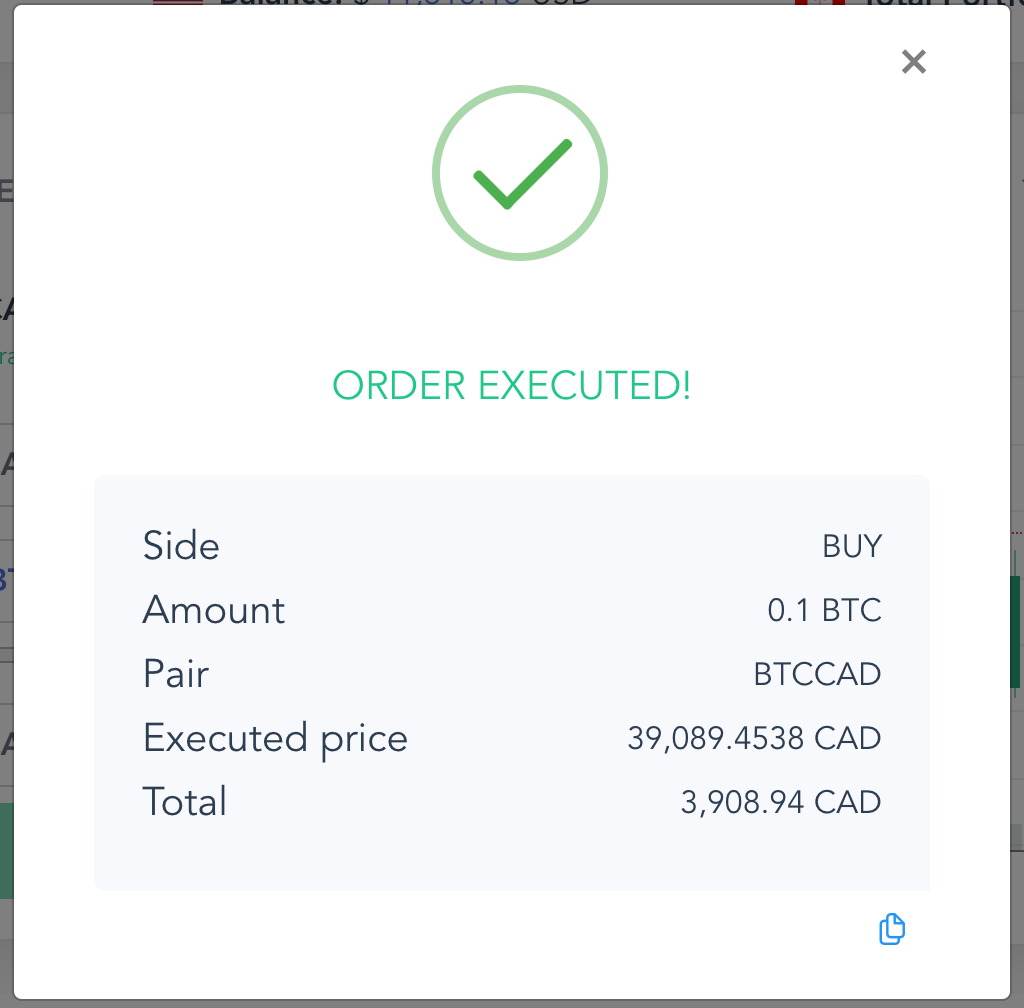

So, is this the feeling of thinking you’re well-positioned before the world flips upside down? Or are you actually right to be ignoring all the doomers? Well, I’m clearly biassed, like super biassed…I am all in — positions set — fly me to the moon, or I’ll take the cat food behind the curtains until things turn around.

Italy was pretty cool. It’s a different type of hustle over there in that it’s pretty much non-existent. Good to be back in Toronto — back-to-back weddings over 2 weeks in 40°C weather was pretty rejuvenating.

Now that I’m back, there’s so much to discuss. First up, the US is getting downgraded. Feel free to skip to the end for Bitcoin stuff.

This week there was some significant financial news concerning the United States government's debt rating. Fitch, a credit rating agency, decided to lower the US sovereign debt rating from AAA to AA+. This move follows a similar downgrade by S&P back in 2011, which also downgraded the US to AA+. The downgrade means that the US no longer holds the highest rating (AAA) which signifies a very low risk of defaulting on its debt obligations.

While credit ratings from these agencies have been criticized in the past, especially during the 2008 financial crisis, it's hard to ignore the implications of this recent downgrade. Credit rating agencies often tend to be lenient with their ratings (you’d understand if you’ve watched The Big Short), so when they decide to downgrade a global leader like the US, it’s…non bene.

The US debt situation has been a major cause for concern, and this downgrade puts it back in the spotlight since the debt-ceiling crisis a few months ago. The government is YOLO’ing out of control, and there’s pretty good reason to think that it might be worse than the AA+ rating suggests. This is evident in the amount of debt the Treasury is planning to take on in 2023, which has raised some eyebrows…

According to the Treasury's new guidance, they are planning to borrow a staggering $1.85 trillion during the second half of this year. That’s TRILLION, with the big T. This number — that looks a lot smaller when I write “trillion” vs showing all the 0’s — indicates that the government is facing significant financial challenges and requires a literal blank cheque to meet its obligations and finance its operations.

The already mounting national debt is spiralling out of control.

The US is now paying ~$1 trillion in interest per year to service their tremendous debt load. Literally the only thing that makes me feel good about my variable interest rate right now — we in this together ✊.

The 'scary chart of the week'

The vicious cycle: the more the USG borrows, the more cautious investors will be about investing in US Treasuries, meaning they will demand higher interest rates to compensate for the perceived risk. As a result, the cost of borrowing for the government would rise, exacerbating the debt situation even further. It could get substantially worse if this cycle leads to further downgrades in the future, further reducing investor confidences and increasing borrowing costs. Gnarly.

Okay, here’s some great Bitcoin stuff to end off this week’s note.

There are two institutions buying up a ton of bitcoin for the long-term acting as a safety net, of sorts, buying the dips creating a price floor.

That is a ton of BTC exiting the system at a rapid pace which will persist as Tether continues to absolutely crush it thanks to — ironically enough — the Fed’s hiking cycle.

Adam Back makes a really good point as to why MicroStrategy will keep the buys coming in this thread below:

Lastly, if you click the image below, you will be directed to an article that outlines why Bloomberg Intelligence analysts just upped the odds of a Bitcoin ETF being approved this year to 65%.

Ultra bullish this fine Friday morning — can you blame me?

Hope you all have a great long-weekend!