Good as Gold (Better as Bitcoin)

Friday September 5th, 2025 - Issue # 113

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Good morning! Apologies all, it’s been a couple of weeks since my last note. I had drafts written out but I just couldn’t hit the send button as there was nothing too interesting going on and I didn’t want to be a burden on the last bit of summer.

But I think we can start there. Summer is traditionally super slow and choppy due to lower liquidity. Professional investors and traders are mostly off the desk at their summer house, cottage, or Euromaxxing with their family before the school year. This summer was no different really. Bitcoin ranged between $110k and $120k with brief moments where it shot to the downside and upside making a very brief stop at new all time high mid-August.

The weather is still nice (for now), and market participants might be feeling a bit sluggish, but you can be sure that September comes with a market reset. I can’t tell you whether that’s immediately good or bad for the price of BTC, but I can tell you that we’re back and things should get really interesting from here.

So, let’s level set. The number one question that I’m seeing out there since we dropped sharply after BTC and ETH made new all time highs is “has BTC topped?”. Firstly, 1 BTC = 1 BTC and if you’re thinking of it in fiat terms in this environment than you’re already doing it wrong. Secondly, during the summer months where the market is choppy, people with too much time on their hands make poor decisions (trading…with leverage). It’s mostly those folks that are asking the question without considering the fundamental regime shift that we’re currently travelling through. It’s nice that we’re all long-term intelligent investors here.

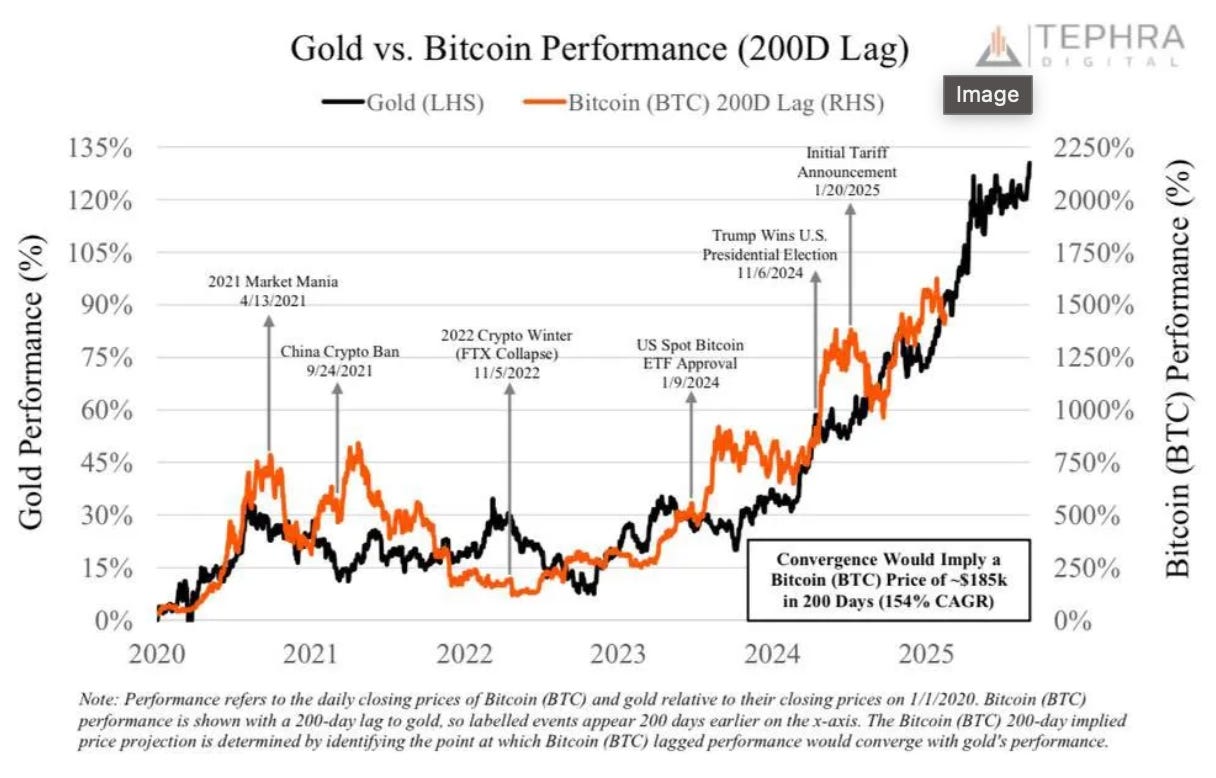

Macro is lining up in Bitcoin’s favor: gold at new highs, long-term yields pushing higher, and the political drumbeat getting louder for lower rates and fresh stimulus. This is the stuff Bitcoin was built for. Bears will show you all of these charts and talk about fibonacci’s and head and shoulders and all these sorts of squiggles. I prefer more simple charts like this:

I’ve wrote many letters on bitcoin vs. gold so you know where I stand on why BTC is far superior. For new subscribers you can check out Fool’s Gold or Goldmember if you want to better understand my view. From a price perspective, one indicator that has never failed me is that when gold breaks out, BTC lags for a bit and then rips ahead.

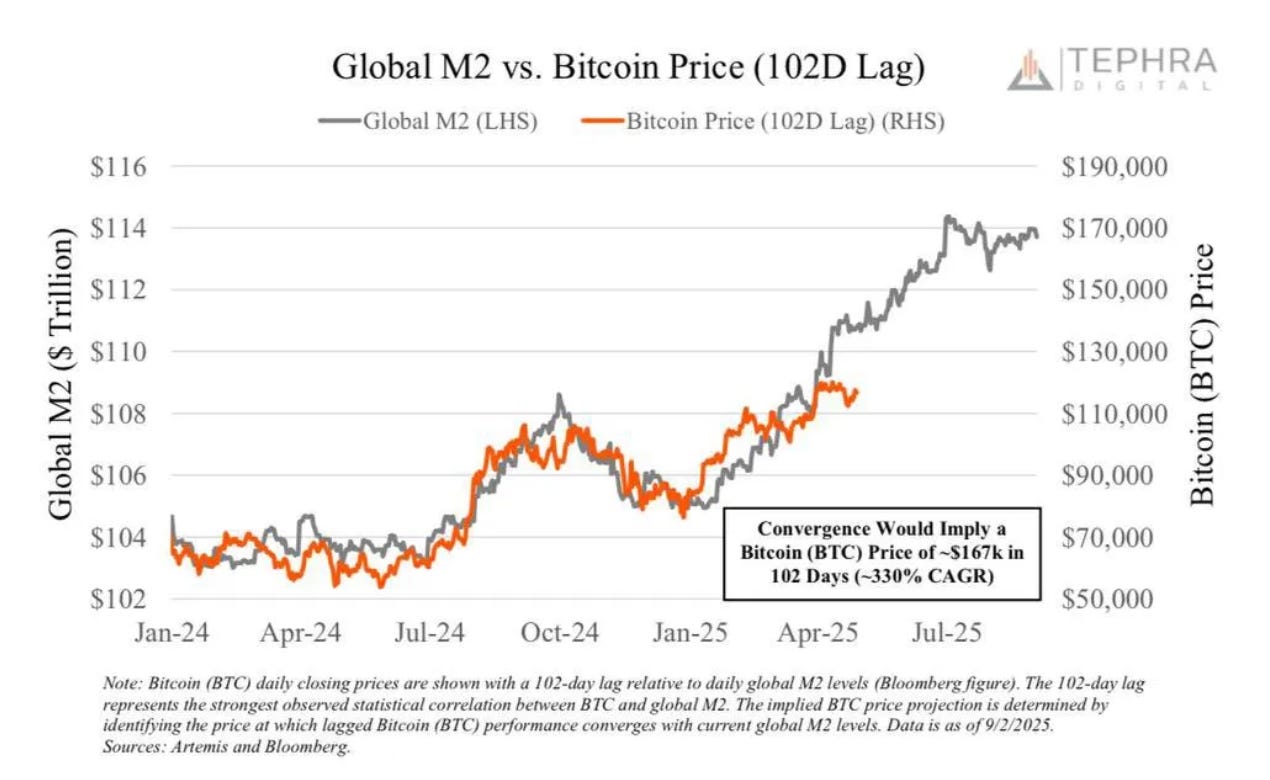

Same with Global M2 vs. BTC. Bitcoin is the macro asset of our time and is the most sensitive to changes in global liquidity. As you can see from the chart below, BTC is lagging as it normally does. If history tells us anything on where we’re headed in the future, we have a lot to look forward to.

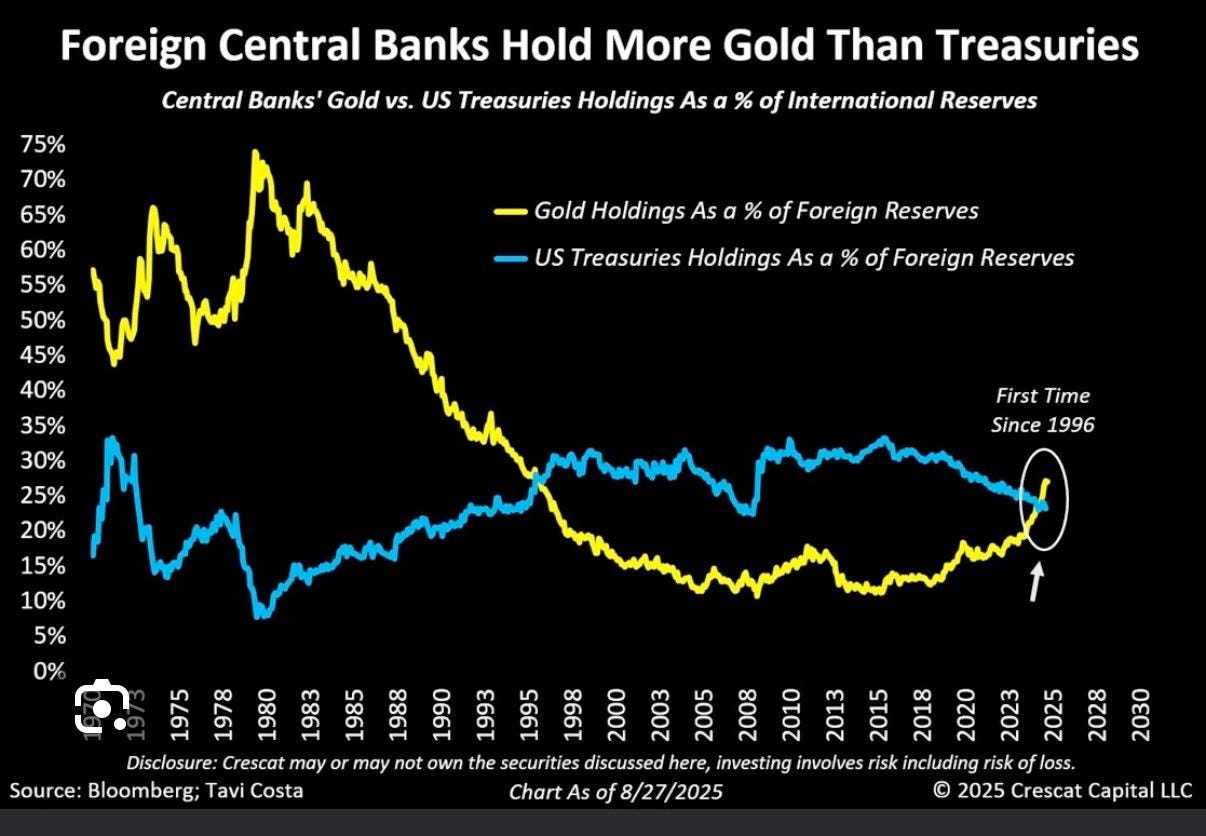

Meanwhile, Bitcoin’s biggest rival — the US dollar — has been bleeding influence. Decades of reckless deficits have already weakened trust, and now the political layer makes it even worse. Under Trump, the US has leaned harder into weaponizing its dominance — unpredictable tariffs, sanctions, and threats that make allies and adversaries alike question whether Treasuries are really “risk-free.”

For a long time, foreign central banks treated Treasuries as the safest place to park reserves. But that faith has cracked. The alternative of choice so far has been the world’s oldest neutral reserve asset: gold. And as the chart shows, for the first time since 1996, foreign central banks now hold more gold than US Treasuries. That’s not just a data point, it’s a regime change.

It also begs a bigger question: does the US even want to be the reserve currency anymore? I think not. For decades, China and other export-driven economies have benefited from America’s role — shipping goods to the US, getting paid in dollars, and then recycling those dollars back into Treasuries. The system worked, but mostly for everyone else.

If the US wants to bring manufacturing back onshore, or tip the balance of trade in its favor, it can’t do it with an overvalued dollar. A strong dollar makes imports cheap and exports uncompetitive. A weaker dollar, on the other hand, boosts US exports and helps drive self-sufficiency. That’s why you’re seeing this quiet shift: America prints, devalues, and slowly backs away from the burdens of reserve currency status.

This shift isn’t just about central bank balance sheets — it’s about trade wars, tariffs, and who sets the rules of globalization. The US–China relationship is the fulcrum here, and it will define how reserve assets are held, valued, and weaponized going forward. We’ll dig deeper into this in future notes.

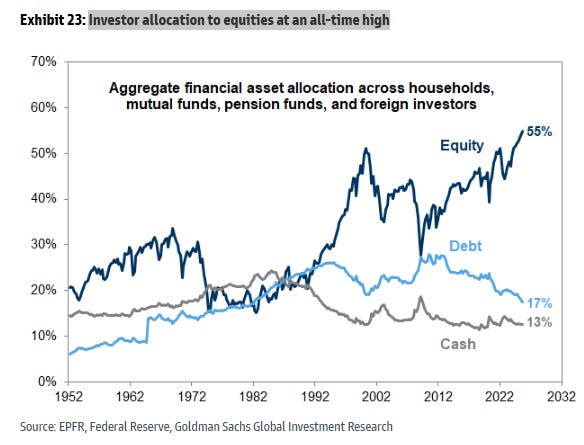

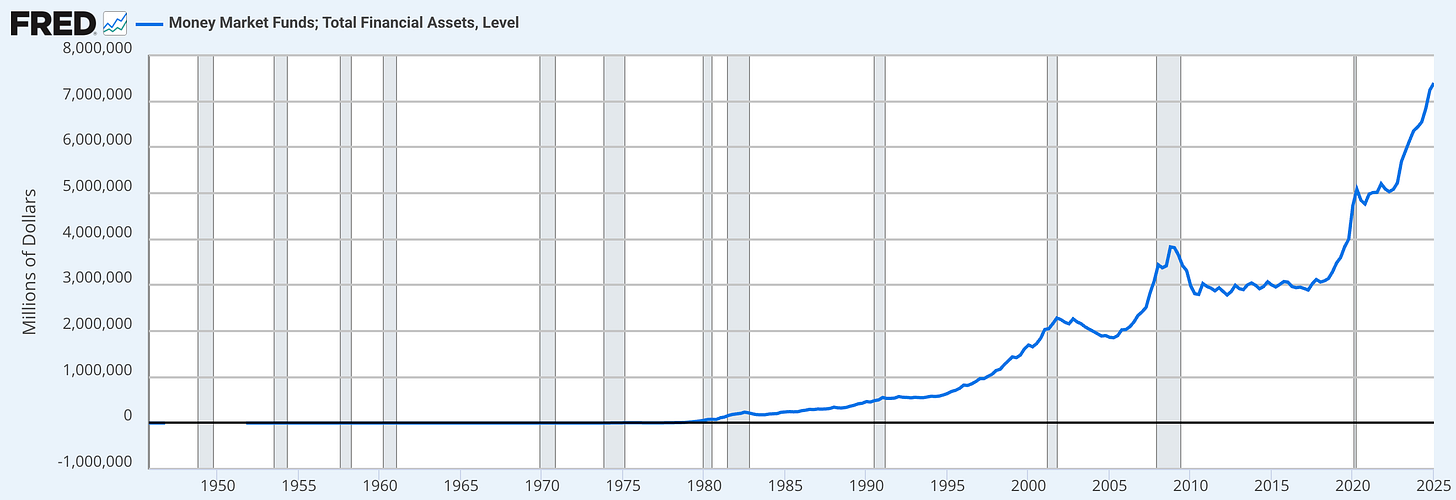

As you can see from the chart below, investors are starting to understand that we’re heading back to a low-rate environment and that cash is trash.

As the Fed cuts rates more than the market expects, I suspect that we will see this chart roll over.

At the end of the day, gold bugs and bitcoiners are fighting the same fight. Gold is having its moment now, and fair enough — it’s the oldest neutral reserve asset we have. But gold’s been monetizing for thousands of years — bitcoin has only had sixteen.

Bitcoin is scarcer, easier to divide, easier to transfer, easier to secure, and harder to seize. In a world that’s moving digital, those traits matter far more than shiny bars in a vault. Which is why I don’t see this as gold’s victory lap so much as the opening act.

And it’s not just Bitcoiners saying it anymore. Even JPMorgan is calling Bitcoin undervalued compared to gold, with “fair value” at $126,000. That’s before considering Bitcoin’s superior properties or the fact it’s still in the early innings of monetization.

The irony is that Bitcoin is still too small for central banks to buy in size. They can’t yet move billions into it without moving the market against themselves. But that’s also the beauty of it — the bigger bitcoin gets, the more liquidity it attracts. And adoption has followed a very clear path: from hobbyist tinkerers, to individual investors, to wealthy individuals, to family offices, to funds, to corporations, to institutions… and eventually, to nation states.

I’ve personally been buying bitcoin hand over fist the last week or so in the $110K range…Satstreet has also been adding to our treasury. I’ve never been more bullish and as Balaji said in his presentation last week…when bitcoin wins…

As most of you know, I listen to a lot of podcasts. Currently, there’s so much great stuff out there at the intersection of bitcoin, macro, AI, and investing that I think it’s time to bring back the weekly recommendations. The first pod listed below I’ve listened to 3 times at 1x speed…