The New Narrative

Friday October 10th, 2025 - Issue # 118

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Speaking of innings, how about these Toronto Blue Jays? I’m a massive Jays fan. Baseball was my sport growing up. I splurged on Game 1 tickets and the atmosphere was absolutely electric. I told myself I’d do one game per series, so I just grabbed tickets for Game 2 while my eyes were still blurry this morning. Let’s go!!!

Anyway, I need to start off by shaking you all a bit. Over 1,500 of you read this every week, and it’s way too quiet out there. Did anyone even notice bitcoin broke its previous all-time high on Monday? We sliced through $126Kk (nearly $177k CAD) like butter and it was crickets at the desk from the retail (HNWI) side. I’ll go on record saying it was the quietest all-time high I’ve ever seen — zero euphoria.

The corporate and institutional side of the desk? Different story. Q4 has been gangbusters for that book. But I’m not surprised, this cycle has been largely institutionally driven. BlackRock came onto the scene last year and absolutely crushed it. Their BTC ETF just passed 800,000 BTC and is now their most profitable ETF. Retail’s nibbling, sure, but they’re not making a dent compared to the sovereign wealth funds and institutions quietly getting their exposure through this vehicle.

While not the biggest ticket, this week Luxembourg invested 1% of their sovereign wealth fund into bitcoin ETFs (click the headline to read the article).

“Some might argue that we’re committing too little too late; others will point out the volatility and speculative nature of the investment,” Bob Kieffer, Luxembourg’s director of the treasury, said in a post on LinkedIn. “Yet, given the FSIL’s particular profile and mission, the fund’s management board concluded that a 1% allocation strikes the right balance, while sending a clear message about Bitcoin’s long-term potential.”

These are serious flows into BTC, but quiet ones. If the market were truly “over,” $110K wouldn’t have held at the end of September. That push to fresh all-time highs in just a few days was an impressive bid — and it wasn’t Saylor in the order books. This is the new narrative on everyone’s mind: the debasement trade.

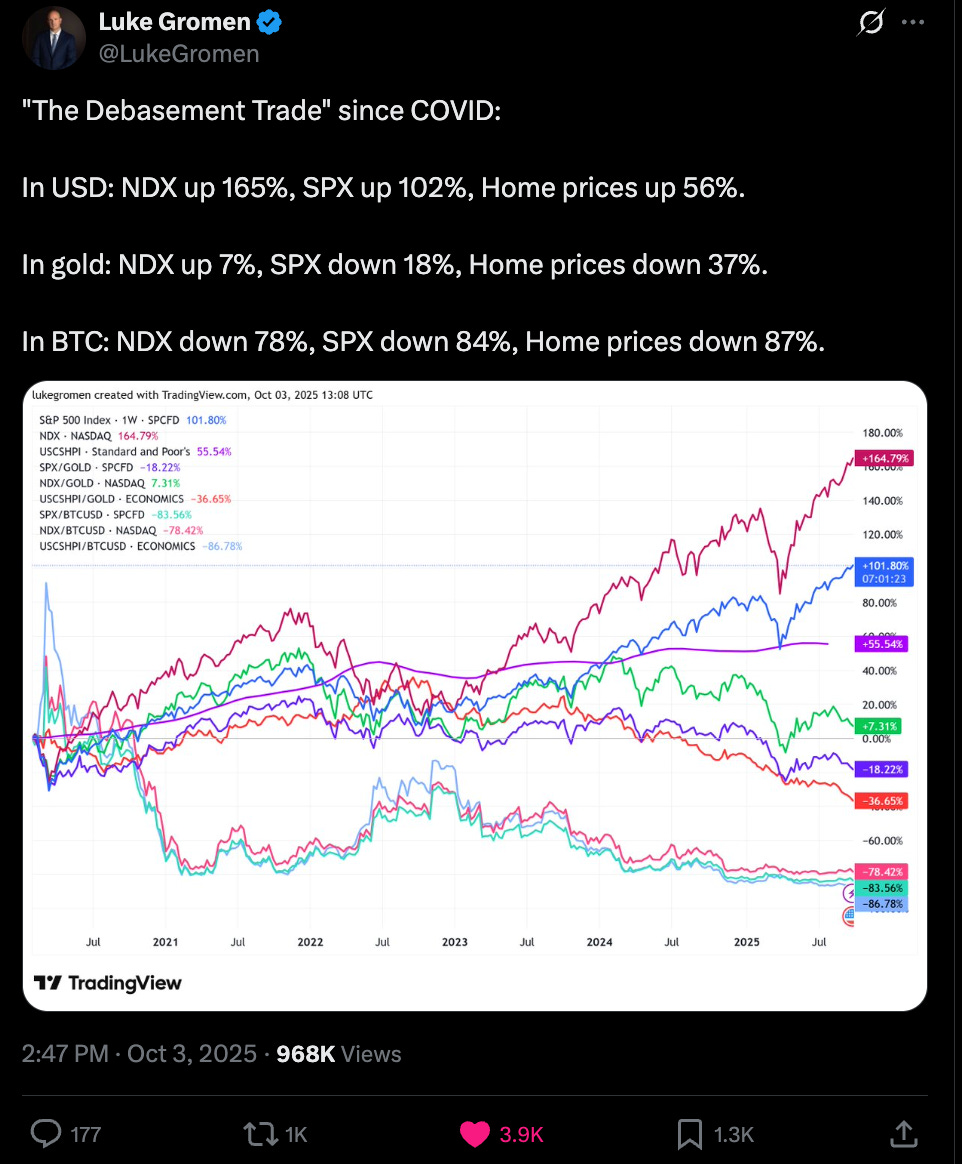

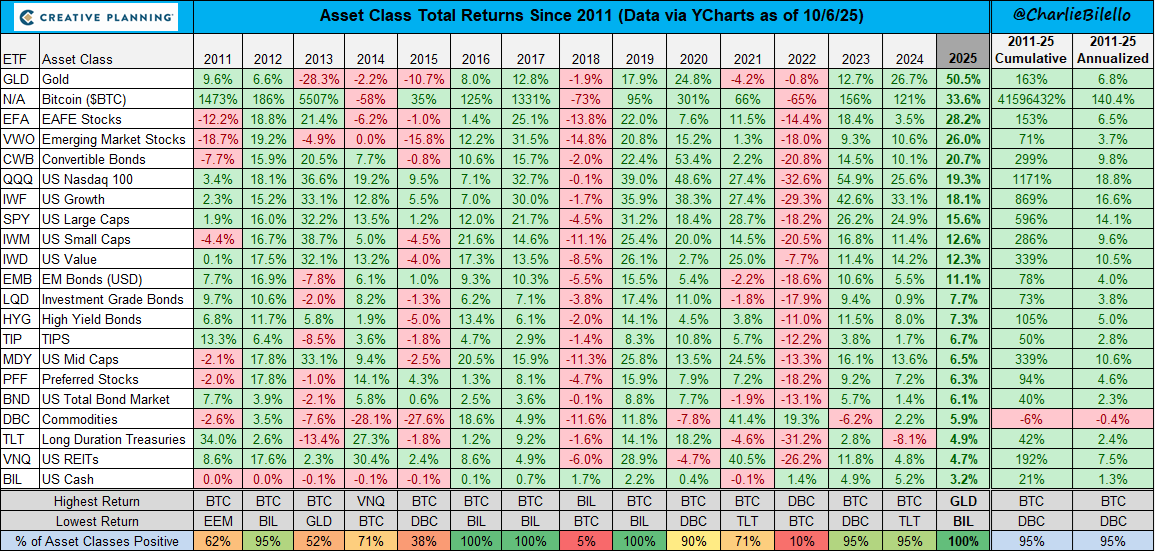

You might feel like you’re crushing it in the S&P 500, but you’re actually getting crushed by a shiny gold rock. Even the Nasdaq is underperforming gold now that it’s ripped past $4k. In BTC terms, everything’s been taken out to the woodshed.

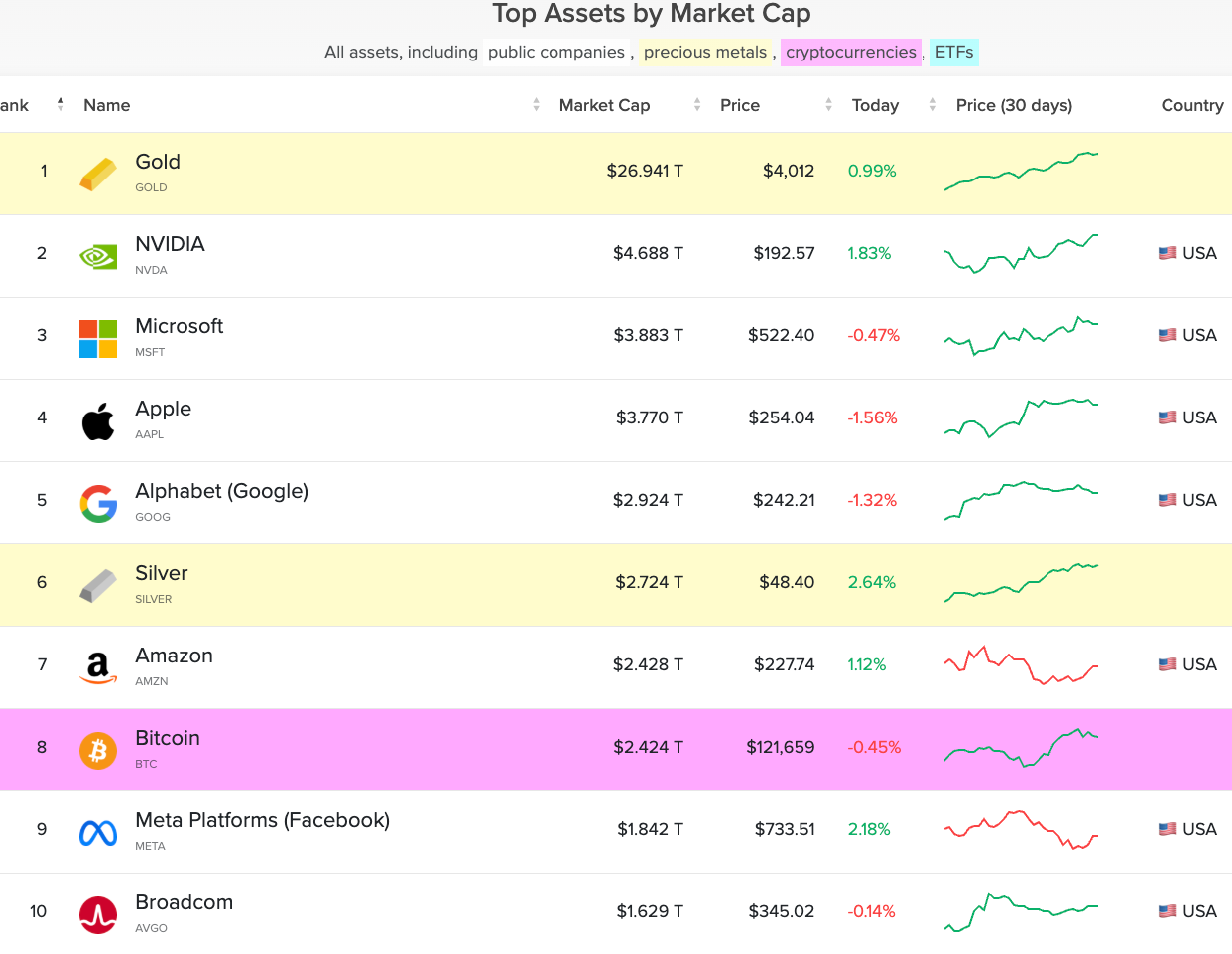

Something’s happening. I suspect the hardest monetary assets are telling us the future before it arrives. I always joke about gold, but it’s impossible to ignore that it’s the best-performing asset this year — and the second-best? Bitcoin. It’s the first time in history both assets are leading the pack, one and two. Are you paying attention anon?

So why is all of this happening?

Because the world is finally waking up to the fact that governments are, in simple terms, broke. Not just “carrying too much debt” broke — I mean objectively bankrupt. The math stopped working years ago, and the only play left is to debase.

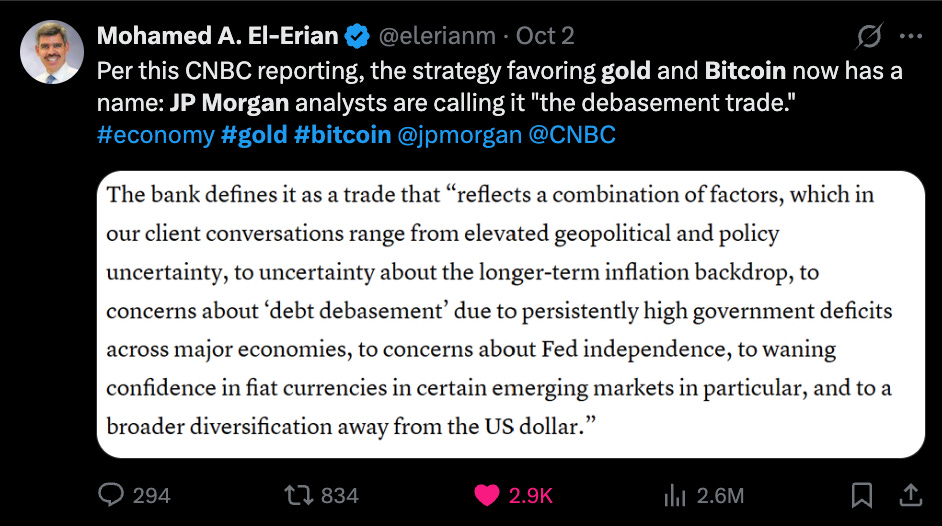

JP Morgan’s research team summed it up well last week. When they asked clients why they were rotating into Bitcoin and gold, the answers were pretty consistent: the world feels like it’s burning, inflation clearly isn’t under control, deficits keep ballooning just to service old debt, the Fed’s no longer acting independently, fiat money looks stranger the more you think about it, and global confidence in the dollar is quietly eroding.

The conversations I’m having at the desk sound pretty similar. Clients with meaningful Bitcoin and risk-asset exposure, many of whom expect some kind of blow-off top later this quarter or early Q1, are wrestling with the same question: if they do sell, what do they even rotate into?

It’s a tough question. Bonds are trash, cash is flaming garbage, and equities are just leveraged inflation trades. There’s nowhere else to hide. Downside from here? Maybe $80K. Upside over the next 5–10 years? $1 million or more. That kind of asymmetry is absurd. Unless you need the money, I can’t think of anything better than BTC or maybe gold to store wealth. Gold could hit $10k+ in the same timeframe. And the higher gold goes, the more room bitcoin has to run.

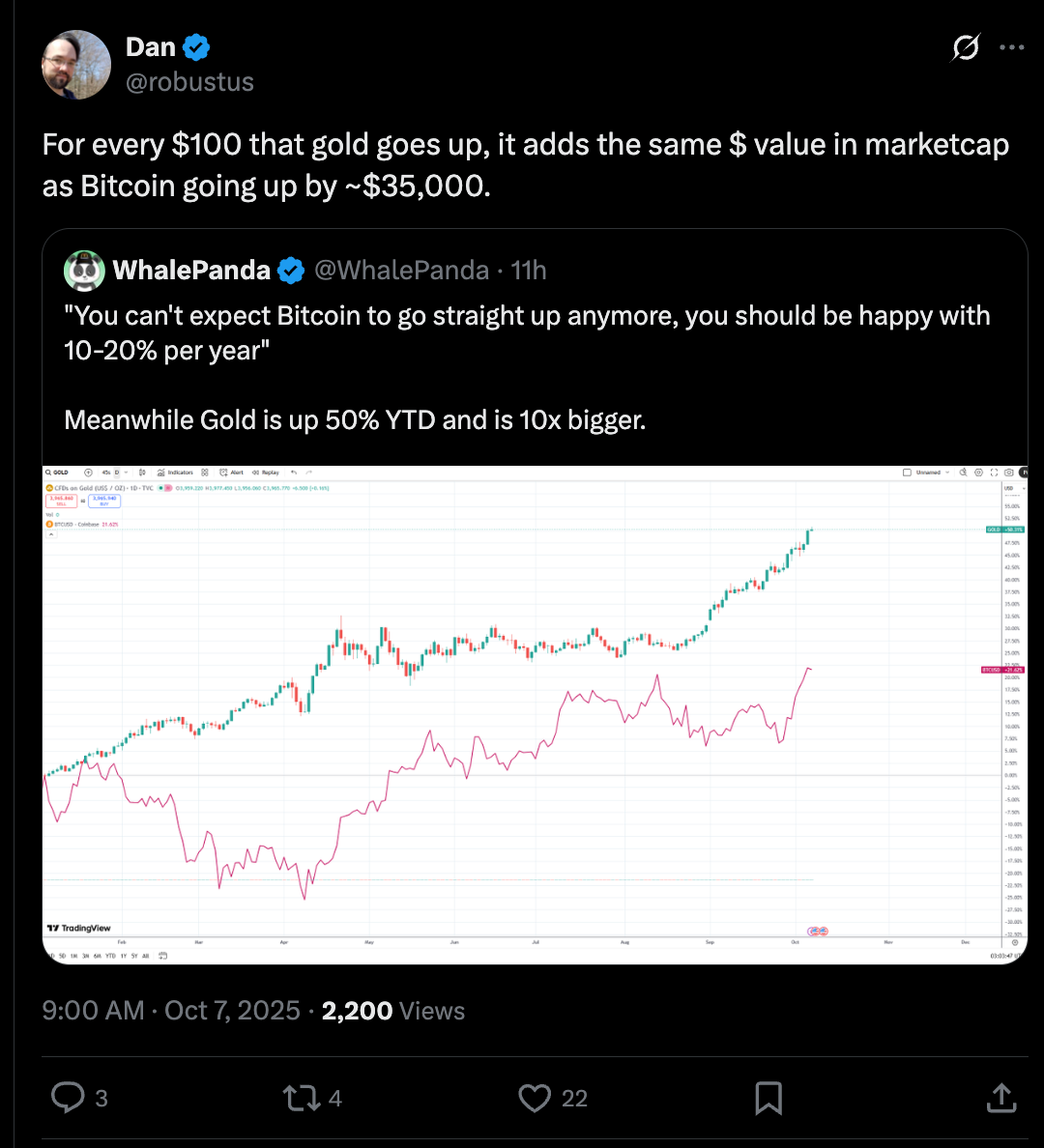

Last time I posted this chart, gold’s market cap was around $24T. It’s added trillions in just a few months and is up 50% YTD. Bitcoin’s sitting at $2.4T and climbing.

And as Dan pointed out this week, every $100 gold goes up adds the same dollar value to global market cap as Bitcoin going up by roughly $35,000. Please, let that sink in.

On top of that, investors are understandably hesitant to hold cash, and the indices don’t look much better. The S&P is basically the Mag7, and the Qs are frothy as hell. The smartest money on the Street is debating whether we’re in 1998 or 1999 — hedging against a blow-off top next year. What’s harder is that no one knows what the world even looks like in five years.

AI is already reshaping everything. If we crack AGI in the next five years, the world, and markets, will look completely unrecognizable. How do you make long-term bets when even the smartest people can’t model what comes next? Time will tell, but eventually it’ll be consensus that the only predictable constant is that there will only ever be 21 million BTC.

Nice to see crypto pioneer Nick Szabo back online — perfectly timed.

Depending on how you look at it, retail’s absence is both good and bad. It’s bad because institutional money is front-running the very people who need bitcoin the most. But it’s good because once retail does show up — and they will — that’s when the cycle ends. That’s when you take some chips off the table and buy yourself a better quality of life.

So how do you know when we’re close? People start calling for $1M Bitcoin. They’ll say the four-year cycle is dead (I’m already seeing this). Your friends and family will start asking if they should buy. That’s when you know we’re getting close.

This interview with legendary macro trader Paul Tudor Jones was all the rage this week.

But here’s the thing…it’s not 1999.

Back then, the U.S. was running a surplus. The Fed was raising rates. There was no QE. Markets were driven by private sector optimism, not trillion-dollar deficits and government life support. Today, everything runs on fiscal stimulus and debt monetization. Liquidity is endless, and every policy move sends waves through global markets.

And in 1999, there was no Bitcoin, no social media, no smartphones. In 2025, everyone carries an escape valve in their pocket.

This doesn’t feel like 1999…it feels like something much bigger.

At some point, narratives stop being forecasts and start being facts. The debasement trade isn’t a theme anymore — it’s the environment. Governments are drowning in debt, gold and Bitcoin are leading all major assets, and money itself has become the variable, not the constant.

So what do you do in a world like that? You pick your constant.

Bitcoin is the only one that fits the bill. It’s global, neutral, and scarce. It doesn’t care who’s in office or what acronym the Fed invents next. It’s the one thing that can’t be debased by design — and that’s exactly why capital keeps flowing in quietly, relentlessly, and in size.

The smartest investors in the world can’t define what the next decade looks like, but they all agree on one thing: they want exposure to scarcity.

That, right there, is the new narrative.